Nearly four years after the pandemic, healthcare is adjusting to a “new normal” that closely mirrors the pre-pandemic momentum toward shifting from volume to value. Healthcare finance and operational leaders are still managing pandemic-driven challenges—ranging from financial stress and workforce shortages to supply chain issues and compliance demands. While the goals of health equity and value-based care are more prominent than ever, many providers feel constrained by existing pressures, making it difficult to embrace new initiatives.

The Push Toward Value-Based Care

Nevertheless, the movement toward value-based models is resurging, with CMS setting an ambitious goal: by 2030, all Medicare fee-for-service beneficiaries and a vast majority of Medicaid beneficiaries should be in a care relationship with a provider accountable for both quality and total cost of care. Policymakers and insurers are driving this shift through Medicare’s evolving payment structures, Medicaid 1115 waivers, and Direct Payment Templates. Many leaders believe that embracing value-based care could eventually alleviate the financial and operational strains they currently face, even though the transition brings immediate costs and complexities.

The Expanding Role of Medicare Advantage & Medicaid Managed Care

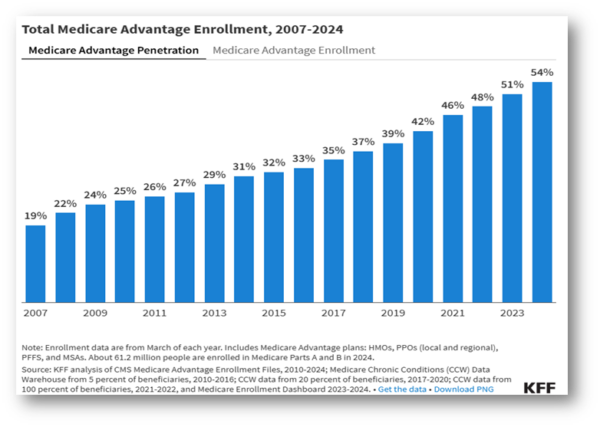

Though many healthcare leaders are focused on larger value-based initiatives that require building infrastructure, capabilities, and capacity for long-term growth, the growing influence of Medicare Advantage (MA) and Medicaid Managed Care Plans is reshaping healthcare finance and adding new layers of complexity. These managed care models place significant pressure on cash flow dynamics across health systems—almost like a “frog in boiling water” scenario. As Medicare Advantage and managed care enrollment grows, so does the need for robust investments in revenue cycle and IT infrastructure to keep pace. According to a 2024 study by the Kaiser Family Foundation, over half (54%) of eligible Medicare beneficiaries are now enrolled in a Medicare Advantage plan, a significant rise from just 31% a decade ago.

Financial and Operational Impacts on Healthcare Providers

This shift has introduced additional pre-authorization requirements, increased denial rates, more complex billing processes, and a multitude of payors that health systems must now manage, all of which compound the demands on revenue cycle management and risk revenue leakage if not addressed proactively.

For healthcare providers, responding strategically to the demands of Medicare Advantage and Medicaid Managed Care requires significant investment in revenue cycle management and IT infrastructure. However, coming out of the pandemic, not all organizations are positioned to afford these upgrades, heightening the risk of revenue leakage and operational strain. Those with the capacity to invest in advanced systems and specialized teams for denial management, payer relations, and compliance will be better equipped to navigate the complexities of managed care effectively.

Strategic Responses to Managed Care Challenges

For providers unable to make these investments independently, exploring partnerships, engaging third-party experts, or sharing resources with another provider offers a viable alternative, enabling them to build capacity gradually and stay competitive in a value-based care landscape. These investments go beyond short-term fixes; they serve as differentiators, positioning organizations on a sustainable path forward, where efficient revenue capture and streamlined processes enhance financial resilience.

Proactive Measures for Healthcare Finance Leaders

Healthcare finance leaders navigating the rise of Medicare Advantage and Medicaid Managed Care must take a proactive approach to revenue cycle and infrastructure investments. Leaders should prioritize tracking key metrics such as days in gross and net receivables, denial rates, authorization timelines, and cash flow stability to assess how effectively their revenue cycle is adapting to managed care demands.

Developing a strategic roadmap for enhancing IT systems, building dedicated teams, or engaging specialized firms will be essential to minimize revenue loss and improve operational efficiency. Treating these investments as critical steps toward resilience enables healthcare organizations to address the immediate complexities of managed care while laying a stronger foundation for long-term financial stability in a value-based care landscape.

If you have any questions or need further guidance, we’re here to help. Please do not hesitate to reach out to discuss your specific situation.

This material has been prepared for general, informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Should you require any such advice, please contact us directly. The information contained herein does not create, and your review or use of the information does not constitute, an accountant-client relationship.