In the last days of 2024, Governor Hochul signed a statewide Short-Term Rental Registry law, meant to address housing challenges, and enhance transparency in the short-term rental market. The law significantly expands the state’s sales tax base to include short-term rentals, impacting hosts and operators of short-term rentals like those shared on Airbnb and Vrbo. Governor Hocul subsequently signed a chapter amendment on February 28, 2025 with additional details meant to assist counties with implementing the law.

Definition of a “Short-Term Rental”

The expanded definition of a “short-term rental” (STR) includes “an entire dwelling unit, or a room, group of rooms, other living or sleeping space, or any other space within a dwelling, made available for rent by guests for less than thirty (30) consecutive days, where the unit is offered for tourist or transient use by the short-term rental host of the residential unit.”

Registry Requirements for Hosts of Short-Term Rentals

Hosts of properties that meet that expanded definition will need to comply with the law’s new registry requirements, including registering their properties with a local registration system and providing information on occupancy rates, and taxes collected, and more. The legislation gives counties the option to create a county-wide short-term rental registry. This registry would allow counties to collect hotel and motel occupancy taxes from short-term rentals, but they must amend their local laws to enable this. If a county chooses not to establish a registry, it can still collect occupancy taxes through voluntary agreements or other local methods with vendors. The data collected from hosts is meant to support local economic development and planning efforts, aiding municipalities in making informed land use decisions.

Sales Tax Implications for Short-Term Rentals

Booking platforms, including Airbnb and Vrbo, will also be required to send counties quarterly reports detailing property locations, occupancy nights, guest counts, and taxes collected. While the Department of State will not maintain its own registry, booking services must also provide the state with quarterly data on bookings facilitated in each county. These measures aim to provide a detailed view of the prevalence and usage of short-term rentals and their impact on local housing affordability.

Perhaps the biggest impact of this law is that short-term rental properties will now be subject to the same sales taxes as hotels. Previously exempt properties, such as bungalows and certain motel-efficiency units, may no longer qualify for those exemptions if they meet the expanded short-term rental definition in the new legislation. The legislation aims to align short-term rentals with the tax framework that applies to traditional lodging businesses.

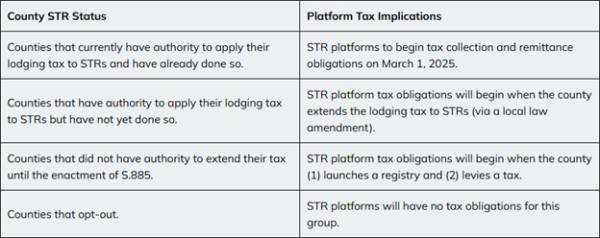

The New York State Association of Counties (NYSAC) has put together a helpful implementation table showing the various timing implications of local tax collection, which will vary based on existing local laws and whether a county opts-in to creating a local registry:

How Hosts Can Navigate These Changes

As of now, there is no immediate action required from hosts. The stated effective date of this law (120 days from its ratification) will be April 21, 2025. As you can see in the chart above, in the interim Counties are working to determine their plans for the opt-in registration systems. As with any new law, many of the actual details on the implementation are still to be determined. The chapter amendment at the end of last month was helpful, but we are still in a waiting period to see if and how various counties implement the registration requirements. Therefore, hosts should stay informed but do not need to take any action at this time.

While these changes may pose challenges, hosts can mitigate impacts by staying informed, seeking professional advice, and maintaining open communication with customers.

If you are affected by this law and need assistance navigating its complexities, we are here to help. Please do not hesitate to reach out to discuss your specific situation.

This material has been prepared for general, informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Should you require any such advice, please contact us directly. The information contained herein does not create, and your review or use of the information does not constitute, an accountant-client relationship.